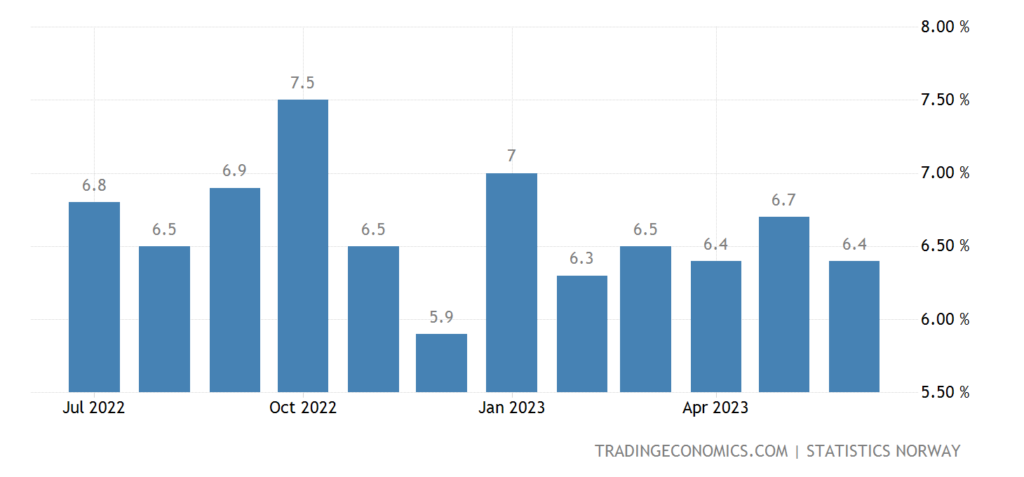

Norway’s core inflation unexpectedly accelerated to a record-high pace of 7% in June. In May, it stood at 6.7%. This increase surpassed analysts’ forecast of 6.6% from a Bloomberg survey and the central bank’s own estimate. The driving force behind this acceleration was the rise in food prices, which saw a 13% increase over the year.

The strong inflation data is likely to reinforce expectations of further interest rate hikes by Norges Bank in the upcoming months. Having already raised rates twice this year, the central bank is widely anticipated to increase rates by another half-point in August.

Following the release of the data, the krone, Norway’s currency, gained strength against the euro. This indicates that investors are anticipating higher interest rates in Norway, making the krone more appealing to them.

The high inflation rate presents a challenge for Norges Bank as it aims to strike a balance between controlling inflation and mitigating the risk of slowing economic growth. The central bank has projected that inflation will peak in the coming months before starting to decline. However, the duration it will take for inflation to return to the central bank’s target of 2.5% remains uncertain.

Furthermore, the high inflation rate poses challenges for Norwegian households as their purchasing power is being squeezed. The government has implemented certain measures to assist households in coping with rising prices, including subsidies for electricity and fuel. However, if inflation remains high, additional measures may be necessary.