Chuck Rettig, the IRS commissioner, expressed concern about the impact of budget cuts on the agency’s efforts to combat tax evasion. He emphasized that reduced funding would lead to fewer audits and enforcement actions, resulting in significant losses in government revenue.

Rettig’s remarks coincide with ongoing discussions in Congress regarding potential reductions in the IRS budget. The Trump administration has proposed a $1.4 billion cut, while some Republican lawmakers are advocating for deeper cuts.

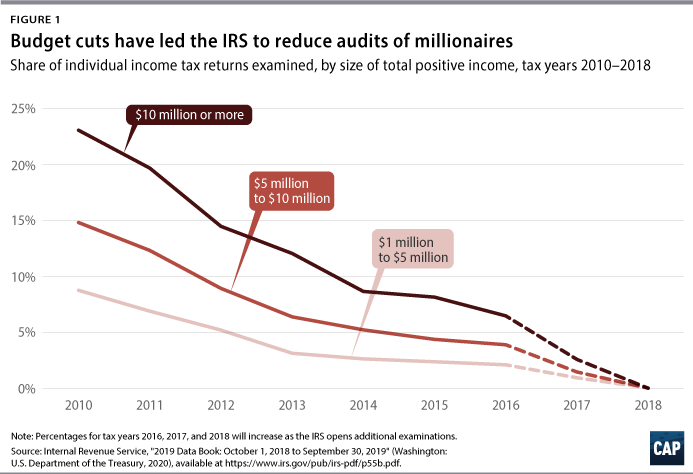

Rettig highlighted the detrimental impact of these cuts on the IRS’s ability to enforce tax laws. He pointed out the existing backlog of millions of audits and stressed that budget cuts would worsen the problem.

The Congressional Budget Office estimates that the proposed cuts would result in a revenue loss of $1.9 billion over the next decade.

Rettig urged Congress to reconsider the proposed cuts, citing challenges faced by the IRS, such as the complexity of the tax code and the increased use of technology for tax evasion.

Rettig expressed the urgent need for more resources instead of fewer, as the IRS is already operating at its limits.

The debate over IRS funding is expected to continue in the coming months, and the decision on whether to approve the proposed cuts remains uncertain. Nevertheless, Rettig’s warning about the implications of reduced funding on the IRS’s ability to combat tax evasion carries significant weight.