Capital One provides various credit card options, such as travel rewards, student, and credit-building cards. Their cards have no foreign transaction fees and offer numerous features and benefits to suit your needs.

When comparing Capital One’s cards to other top credit cards, consider their terms and provisions. While they offer a wide range of cards, they may not always have the best market offerings.

Notably, Capital One excels in customer satisfaction, ranking highest in mobile app satisfaction and online banking satisfaction among national banks, as per the 2022 JD Power studies.

Capital One Venture X Rewards Credit Card

The Capital One Venture X Rewards card is a high-end travel rewards card, providing excellent value. You can earn 2 miles per $1 on purchases, 5 miles per $1 on flights through Capital One Travel, and 10 miles per $1 on hotels and rental cars booked via Capital One Travel. For a welcome bonus, you can earn 75,000 miles after spending $4,000 on purchases in the first three months of account opening.

Thankfully, there are no foreign transaction fees with this card. Moreover, the card offers numerous benefits, such as airport lounge access, cell phone protection, and the ability to transfer miles to travel and hotel partners. One of its standout features is the annual statement credit reimbursement for travel bookings through Capital One Travel, up to $300 per year.

Capital One Venture Rewards Credit Card

The Capital One Venture Rewards credit card provides decent rewards for a fair annual fee. It allows flexibility in redeeming and transferring points to partners, making it ideal for frequent travelers. While it competes with other travel cards in this price range, it offers excellent value to the right cardholder.

The card has an annual fee of $95. When using it for purchases, you can earn 5 miles per $1 on hotels and rental cars through Capital One Travel and 2 miles per $1 on other purchases. Additionally, a welcome bonus of 75,000 miles awaits those who spend $4,000 on purchases within the first three months of account opening. Notably, there are no foreign transaction fees.

The Capital One Venture Rewards program offers various benefits to enhance your travel experience. It provides two complimentary airport lounge visits per year at Capital One Lounges or partner lounges, a credit of up to $100 toward Global Entry or TSA Precheck, 24-hour travel assistance, and auto rental collision damage waiver. Furthermore, rewards can be redeemed via PayPal, Amazon.com, Capital One Travel, and several other methods. Convenient features include virtual card numbers from Eno, $0 fraud liability, autopay, 24/7 customer service, and a mobile app for easy access.

Capital One VentureOne Rewards Credit Card

The VentureOne Rewards card targets infrequent travelers seeking a low-cost, simple option with occasional rewards. However, those desiring more benefits and higher rewards should consider the Venture Card. With an annual fee of $0, the VentureOne Rewards card offers 5 miles per $1 spent on hotels and rental cars booked through Capital One Travel. Additionally, you earn 1.25 miles per $1 on other purchases.

New cardholders can earn a welcome bonus of 20,000 miles by spending $500 on purchases within the first three months of opening their account. There are no foreign transaction fees. Among its benefits are a price match guarantee through Capital One Travel, auto rental collision damage waiver, and no expiration on earned rewards. Cardholders can access the Capital One Lounge, enjoy travel accident insurance, and receive an extended warranty benefit.

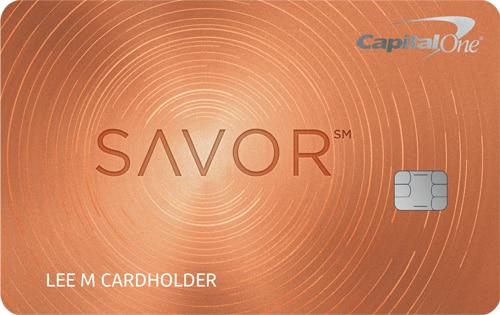

Capital One Savor Cash Rewards Credit Card

The Capital One Savor Rewards Card caters to food and fun enthusiasts. It offers high rewards for dining, entertainment, streaming, and groceries. Whether you dine out frequently or prefer eating at home, this card suits both preferences.

With an annual fee of $95, the card provides attractive benefits. You can earn 5% cash back on hotels and rental cars booked through Capital One Travel, 4% cash back on dining, entertainment, and streaming services, 3% cash back at grocery stores (excluding superstores), and 1% on all other purchases.

Moreover, as a welcome bonus, you get a $300 cash bonus after spending $3,000 on purchases within the first three months of opening the account. The card also comes with the advantage of no foreign transaction fees, making it suitable for international travelers.

Besides these rewards and perks, the Capital One Savor Rewards card has additional benefits. Your rewards won’t expire, and you can enjoy a complimentary Uber One membership until 11/14/2024. Plus, there are no redemption minimums, making it easy to redeem your earned rewards. Additionally, the card offers extended warranty benefits to give you added protection on qualifying purchases.

Capital One SavorOne Cash Rewards Credit Card

The Capital One SavorOne Rewards credit card is perfect for those averse to annual fees. It offers a generous cash-back rate similar to the Savor Rewards card, but with no yearly fee and mostly the same benefits.

There’s no annual fee associated with this card. You can earn attractive rewards, such as 3% cash back on dining, entertainment, popular streaming services, and grocery stores (excluding Walmart and Target). Moreover, you get 5% cash back on hotels and rental cars booked through Capital One Travel, 8% cash back on Capital One Entertainment purchases, and 1% on all other purchases.

To sweeten the deal, you can earn a $200 cash bonus by spending $1,000 on purchases within the first three months of opening the account. Best of all, there are no foreign transaction fees.

Apart from the rewarding benefits, the Capital One SavorOne card offers additional perks like rewards that never expire. You also receive a complimentary Uber One membership extended through 11/14/2024.

Redeeming rewards is hassle-free, as there are no minimum redemption requirements. Moreover, you enjoy extended warranty benefits, travel accident insurance, and access to Capital One Shopping, where you can redeem rewards with PayPal or on Amazon.com purchases.

Capital One QuicksilverOne Cash Rewards Credit Card

The QuicksilverOne is designed for fair credit, with few cash-back cards in this category. It stands out from secured cards. Its annual fee is $39, and it offers 1.5% cash back on all purchases. Moreover, you get 5% cash back on hotels and rental cars booked through Capital One Travel.

Although there’s no welcome bonus or foreign transaction fees, it still has attractive benefits. The card provides automatic credit line consideration within 6 months and rewards points that never expire. Additionally, you have the flexibility to redeem rewards as a check, statement credit, or on gift cards. The card also offers automatic credit line reviews.

Capital One Quicksilver Secured Cash Rewards Credit Card

The Capital One Quicksilver Secured Cash Rewards Credit Card provides a secure option with rewards. No annual fee and a generous cash back program make it appealing. Unlike typical secured cards, you can earn rewards like unsecured credit cards. However, a minimum deposit is required to get the card.

This card offers several benefits, including automatic credit line reviews, rewards that never expire, and multiple redemption options. You can redeem rewards as a check, statement credit, or for gift cards. It also provides autopay, the ability to add authorized users, and 24/7 customer service.

The Capital One Quicksilver Secured Rewards card offers extra security features such as virtual card numbers from Eno, $0 fraud liability, card lock, and CreditWise features. Additionally, the mobile app allows emergency card replacement and access to Capital One travel services.

As for the rewards, you earn 1.5% cash back on purchases and 5% cash back on hotels and rental cars booked through Capital One Travel. There’s no welcome bonus or foreign transaction fees associated with this card.

In summary, the Capital One Quicksilver Secured Cash Rewards Credit Card combines security and rewards, making it a valuable choice for many individuals. Its benefits, lack of annual fees, and additional security features enhance the overall cardholder experience.

Capital One Platinum Secured Credit Card

The Capital One Platinum Secured Card aims to boost credit scores for users. To activate the account, a refundable security deposit is required. After five timely monthly payments, a review is conducted for a potential credit line increase.

This card offers several advantages. It comes with a $0 annual fee, no rewards or welcome bonus, and no foreign transaction fees. Setting up autopay enables automatic bill payments each month, while an authorized user can be added. The card provides 24/7 customer service support and enhanced security for online purchases through virtual card numbers offered by Eno. Additionally, CreditWise from Capital One helps users monitor their credit scores over time.

Should you get a Capital One credit card?

Capital One credit cards cater to various needs like financial management, credit score building, and rewards programs. With a wide range of options, they aim to meet customer requirements effectively. Deciding whether it’s the best card depends on aligning your financial situation with the right fit, be it from Capital One or another issuer.

For frequent travelers, Capital One travel cards shine due to the absence of foreign transaction fees. While other issuers might offer more luxurious perks or travel credits, Capital One’s options are highly regarded for their value. These cards rank well on lists for the best travel credit cards and cards suited for dining benefits.

Building credit and earning rewards simultaneously are possible through Capital One’s choices for those with fair or limited credit history, including options tailored for students.

Capital One takes pride in its diverse array of offerings, with several cards designed for different credit ratings and annual fee structures. Whether you prefer dining rewards, travel perks, or flat-rate rewards, you can find a card that aligns with your willingness to pay an annual fee and matches your credit rating.

How much could the typical household earn in rewards with a Capital One card?

We assess rewards credit cards based on average household credit card spending, derived from publicly available data and government sources. For a household in the 50th percentile of wage earners, we estimate an annual income of approximately $84,352, with around $25,084 spent on the credit card each year.

Let’s take an example with the Capital One Quicksilver card, which offers an unlimited 1.5% cash back on all eligible purchases. Our analysis indicates that the typical household could earn approximately $376 in cash back annually from using this card.

Guide to Capital One credit cards

Capital One provides various credit cards to suit individual consumers’ needs. Those with excellent credit can enjoy valuable reward-card options, including Capital One points and cash-back rewards on everyday purchases. Only a few cards lack rewards, mainly intended for credit building or rebuilding.

Besides, Capital One cards offer convenient benefits like 24/7 customer service, $0 fraud liability, and mobile and online banking. They also provide secured options for those starting out or rebuilding credit, with lower limits and deposit requirements, alongside unsecured options with reduced rewards and benefits.

While student options are available, we recommend comparing them with the best student cards and first credit cards from other issuers. Whichever Capital One card you choose, make sure to pay your balance in full each month to avoid interest charges or late payment penalties.