Alex Mashinsky, a Ukrainian-born American entrepreneur, founded Celsius Network in 2018, a cryptocurrency lending platform promising high interest rates on deposits. However, the company faced financial troubles in 2022 when cryptocurrency values plummeted, eventually leading to its bankruptcy filing in July that year.

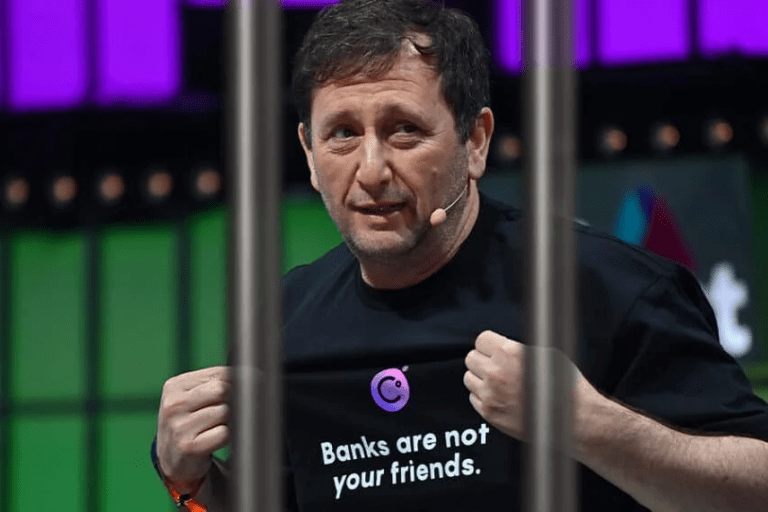

On July 13, 2023, authorities arrested Mashinsky and charged him with fraud and market manipulation. Prosecutors alleged that he misled investors, falsely claiming Celsius was profitable with a strong track record. Additionally, they accused him of personally gaining $42 million by selling his holdings of the Cel token.

The bankruptcy has left Celsius users doubtful about receiving their money back in full. A U.S. bankruptcy judge ruled that Celsius primarily owns customer crypto deposits but lacks sufficient funds for full repayment.

Mashinsky maintains his innocence and is presently free on bail. The case is ongoing, and the extent of his responsibility for Celsius Network’s debts remains to be determined. The incident, combined with the company’s bankruptcy, has shaken the confidence of many cryptocurrency investors.

Before Celsius Network, Mashinsky co-founded VoiceSmart, a firm providing telecommunications switches for voice and Voice over IP call routing.

As the legal proceedings continue, stakeholders in the cryptocurrency industry closely monitor the outcome of the case against Mashinsky and its potential implications for the broader market. The downfall of Celsius Network serves as a cautionary tale, highlighting the risks and uncertainties inherent in the cryptocurrency sector.

Investors and industry players now place a premium on transparency, financial stability, and regulatory compliance to avoid falling victim to similar situations. The cryptocurrency landscape continues to evolve, with lessons learned from Celsius Network’s demise shaping the future of the market.