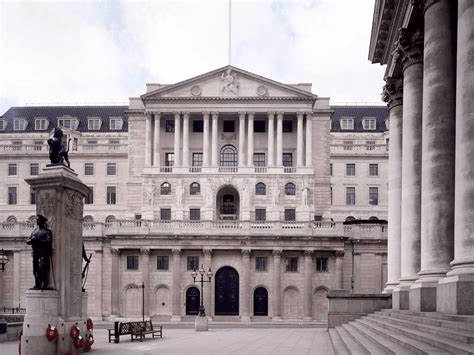

The Bank of England is feeling the heat as high inflation in the UK persists, compelling the central bank to consider further interest rate increases. With an annual inflation rate of 8.7%, the highest in four decades, the figure remains well above the Bank’s target of 2%.

Since December 2021, the Bank has already implemented five interest rate hikes, bringing them to 1.25%. However, economists assert that additional rate increases will be necessary to rein in inflation.

The Bank of England finds itself in a delicate balancing act, aiming to raise rates sufficiently to curb inflation without plunging the country into a recession. Excessive rate hikes could potentially trigger job losses and impede economic growth.

The impact of high inflation is placing a burden on household budgets. Rising living costs combined with stagnant wages are eroding real incomes, making it increasingly challenging for individuals to afford essential goods and services.

The Bank of England is hoping to bring inflation under control by tightening monetary policy.

Here are the points in more detail:

- Tightening monetary policy: The Bank of England can raise interest rates to make it more expensive for businesses and consumers to borrow money. This can help to slow down the economy and bring inflation under control.

- Factors contributing to high inflation: The war in Ukraine has pushed up energy prices. Which has contributed to inflation in the UK. The global supply chain crisis has also disrupted the flow of goods and services. Global supply chain has made it more expensive to produce and transport goods. Additionally, strong demand as the economy recovers from the COVID-19 pandemic has also contributed to inflation.

- Global problem: Inflation is not just a problem in the UK. It is a global problem, and many countries are facing rising inflation. This makes it more difficult for the Bank of England to bring inflation under control, as it cannot act unilaterally.

While the Bank of England faces a daunting task in addressing inflation. It is crucial to recognize that this is a global problem, and the UK is not alone in grappling with this challenge.

Read China’s Central Bank Cuts Key Interest Rates to Boost Economic Growth