In the year 2023, forget about fancy things like the metaverse or blockchain. The big trend for investing is artificial intelligence (AI), and there’s a good reason for that. In the past year, the AI industry has been booming, thanks to innovations like the OpenAI chatbot ChatGPT. As AI keeps getting more influential, investors can make a lot of money from it.

Christopher Gannatti, the head of research at WisdomTree, says that the buzz around AI is totally justified. AI has the potential to change everything about how we live, work, and invest, especially with ChatGPT on the scene.

Lots of big tech companies are jumping on this trend and changing their strategies to focus on AI. According to the financial data company FactSet, 110 companies in the S&P 500 mentioned “AI” in their earnings calls in the first quarter of 2023, and tech companies led the way.

But here’s the tricky part: figuring out which AI stocks are the best to invest in. The AI landscape is huge, with tons of companies and different technologies. So, how can an investor make sense of all this and take advantage of the growth potential without getting overwhelmed or taking too much risk?

The answer is a special kind of investment fund called an exchange-traded fund (ETF) that focuses on AI stocks. These ETFs give investors a way to invest in a bunch of AI-related companies all at once. To help investors find the best AI ETFs out there, we ranked six of them based on things like how much money they manage, how much they charge, and what their strategy is.

Here are the top AI ETFs we found:

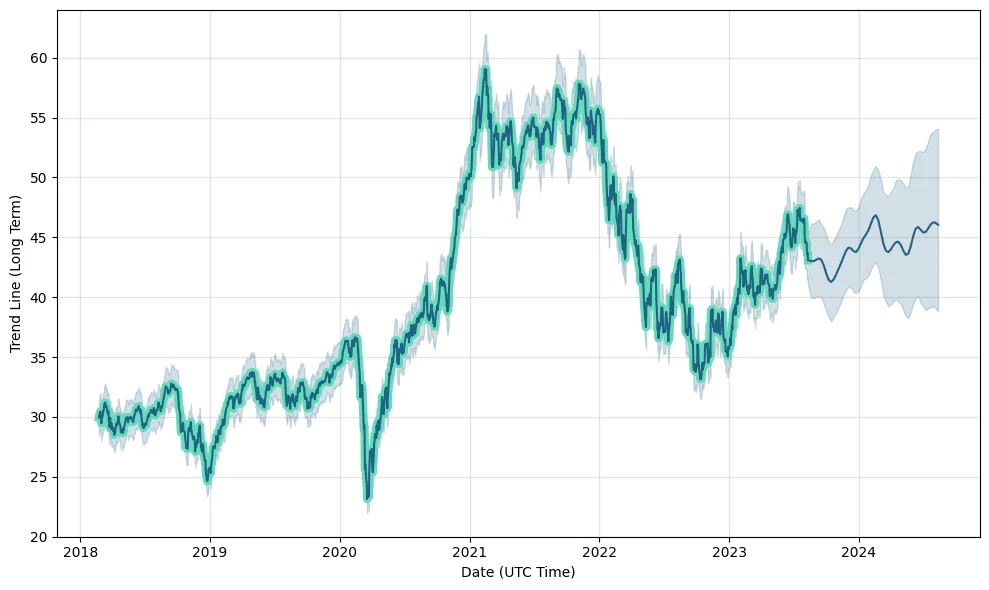

Global X Robotics & Artificial Intelligence ETF (BOTZ)

- Cost: 0.69%

- Managed Money: $2.4 billion

This ETF is all about the connection between robots and AI. It’s like they’re dancing together in the world of finance.

iShares Robotics and Artificial Intelligence Multisector ETF (IRBO)

- Cost: 0.47%

- Managed Money: $495 million

This ETF is like a mixtape of different sectors, all coming together with AI and robotics as the theme.

Global X Artificial Intelligence & Technology ETF (AIQ)

- Cost: 0.68%

- Managed Money: $510 million

Imagine AI and technology holding hands and creating something new. That’s what this ETF is all about.

First Trust Nasdaq Artificial Intelligence and Robotics ETF (ROBT)

- Cost: 0.65%

- Managed Money: $426 million

This ETF is like a story about how AI and robots join forces, making the Nasdaq stock market a little bit more futuristic.

WisdomTree Artificial Intelligence and Innovation Fund (WTAI)

- Cost: 0.45%

- Managed Money: $159 million

This fund is all about combining AI with innovation, like a recipe for future success.

Roundhill Generative AI & Technology ETF (CHAT)

- Cost: 0.75%

- Managed Money: $89 million

This ETF is like a garden of technology where AI is the secret ingredient that makes things grow.

Here’s a quick summary of the best AI ETFs:

| Fund | Cost | 3-Year Return |

|---|---|---|

| Global X Robotics & Artificial Intelligence ETF (BOTZ) | 0.69% | 6.59% |

| iShares Robotics and Artificial Intelligence Multisector ETF (IRBO) | 0.47% | 5.15% |

| Global X Artificial Intelligence & Technology ETF (AIQ) | 0.68% | 10.98% |

| First Trust Nasdaq Artificial Intelligence and Robotics ETF (ROBT) | 0.65% | 8.5% |

| WisdomTree Artificial Intelligence and Innovation Fund (WTAI) | 0.45% | N/A |

| Roundhill Generative AI & Technology ETF (CHAT) | 0.75% | N/A |

And now, let’s talk about why some funds didn’t make the cut:

- We started by excluding ETFs that aren’t purely focused on AI. If they’re all about technology or something else, they didn’t make the list.

- We also left out ETFs that use AI to help with investing decisions. These ETFs might use AI, but they’re not fully AI-focused in their investments.

- ETFs with a short-term focus, like ones that go up when AI stocks go down, didn’t fit our criteria. They’re better for short-term trading, not long-term investing.

- Because AI investing is still pretty new, we only looked at ETFs with at least $50 million in managed money. This helped us focus on the bigger, more established ones.

- Lastly, we made sure to include only ETFs with a cost of 0.75% or lower. The cost matters because it affects how much money you make over time as an investor.

So, our rankings were based on things like managed money, how much the ETF focuses on AI, its type, cost, and a few other important factors.