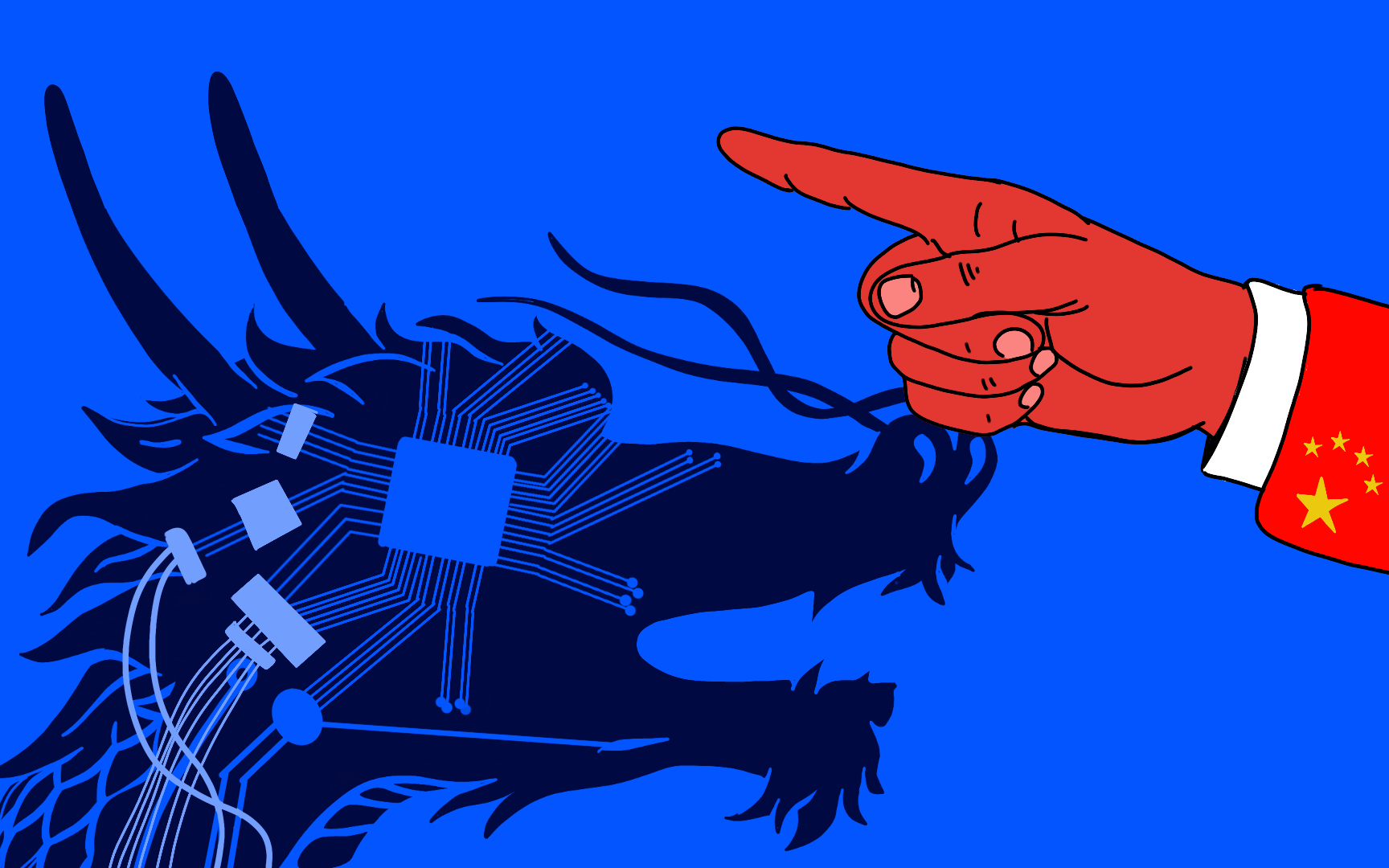

Beijing’s regulatory crackdown on the tech industry has had a significant impact on the value of Chinese tech companies. According to data from Refinitiv, the market capitalization of China’s top 10 tech companies has fallen by more than $1 trillion since the crackdown began in late 2020.

This is equivalent to the entire economy of the Netherlands. The crackdown has targeted a wide range of practices in the tech industry, including data privacy, antitrust, and financial regulation. The government has also cracked down on the education sector and the gaming industry.

The reasons for the crackdown are complex. Some analysts believe that the government is concerned about the growing power of tech companies and their potential to challenge the authority of the Communist Party. Others believe that the government is trying to protect consumers from unfair practices and to ensure that the tech industry is more compliant with regulations.

The crackdown has had a mixed impact on the Chinese tech industry. On the one hand, it has led to some reforms that could make the industry more sustainable in the long term. For example, the government has cracked down on the practice of data harvesting, which has raised concerns about privacy.

On the other hand, the crackdown has also led to job losses and a slowdown in innovation. It is still too early to say what the long-term impact of the crackdown will be. However, it is clear that it has had a significant impact on the value of Chinese tech companies and the way that the industry operates.

Here are some of the specific measures that the Chinese government has taken to crack down on the tech industry:

- Data privacy regulations: The government has passed new regulations that give consumers more control over their personal data. These regulations have made it more difficult for tech companies to collect and use data without the consent of users.

- Antitrust regulations: The government has cracked down on anti-competitive practices in the tech industry. For example, it has forced Alibaba to sell off its stake in the financial technology company Ant Group.

- Financial regulations: The government has tightened financial regulations for tech companies. This has made it more difficult for tech companies to raise money from investors and to make acquisitions.

- Education regulations: The government has cracked down on the for-profit education sector. This has led to the closure of many private tutoring companies and has made it more difficult for students to access after-school tutoring.

- Gaming regulations: The government has imposed restrictions on the amount of time that minors can spend playing video games. This has led to a decline in the gaming industry.