American Express is a renowned credit card issuer, known for its premium charge cards and generous rewards. When you hear the name American Express or Amex, you likely think of their exclusive perks and rewards.

The best American Express cards have the potential to earn you substantial rewards, amounting to hundreds of dollars per year. Additionally, they offer luxurious benefits such as premium lounge access and valuable credits.

To help you find the perfect Amex card for your specific spending needs, we have carefully reviewed their offerings. Keep in mind that while Amex provides a wide range of credit cards, the ones mentioned above might not always be the best option for your spending patterns and preferences. For a comprehensive view of the top credit cards, make sure to compare these Amex cards with the ones listed on our other recommendations.

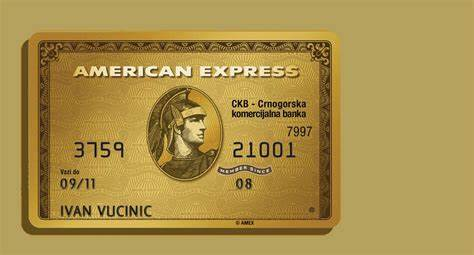

American Express® Gold Card

The American Express® Gold Card is ideal for foodies who love to travel, offering generous rewards on dining and flights. With Uber Cash and dining credits, cardholders can offset the $250 annual fee.

Its rewards program includes 4 Membership Rewards points per $1 spent at restaurants, takeout, and U.S. delivery, 4 points per $1 at U.S. supermarkets (up to $25,000 per year, then 1 point), 3 points per $1 on flights directly booked with airlines or through Amex Travel, and 1 point per $1 on other eligible purchases.

No foreign transaction fees apply, and the card provides perks like up to $120 in Uber Cash and dining credits, $10 monthly statement credits at select establishments, $100 experience credit for eligible hotel stays, baggage insurance, secondary auto collision damage waiver, and access to Amex Offers.

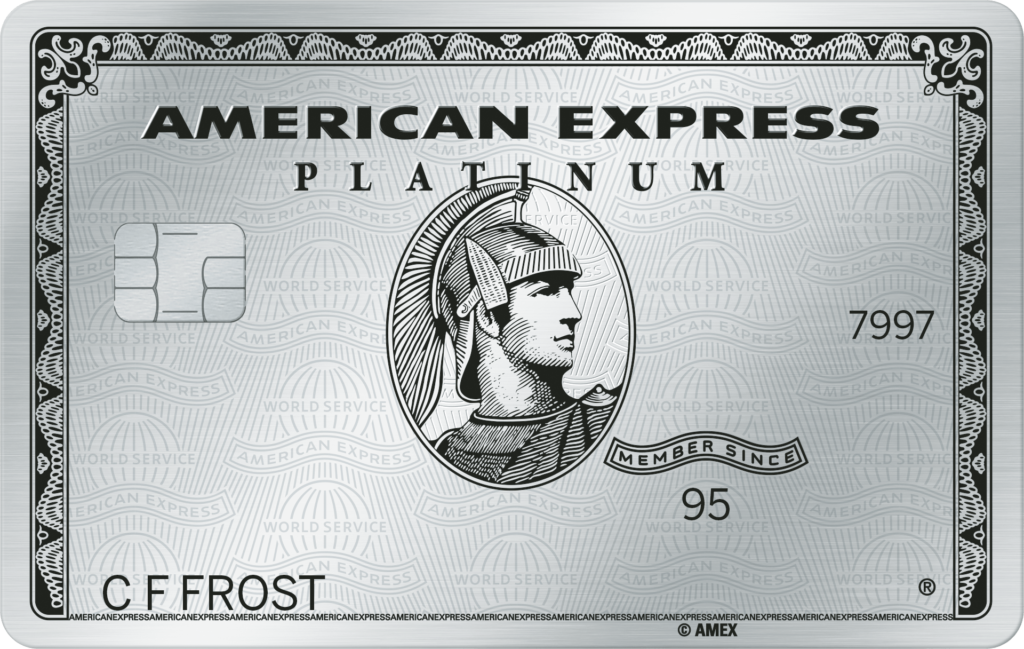

The Platinum Card® from American Express

The Platinum Card® from American Express caters to those seeking extensive airport lounge access and upscale benefits. Despite the $695 annual fee, it offers valuable credits for various expenses.

Rewards include 5 Membership Rewards points per $1 on flights directly booked with airlines or Amex Travel (up to $500,000 per year), 5 points per $1 on prepaid hotels through Amex Travel, and 1 point per $1 on other purchases.

No foreign transaction fees are charged. The card provides a multitude of credits that, when maximized, could be worth thousands, making it attractive for lounge access enthusiasts.

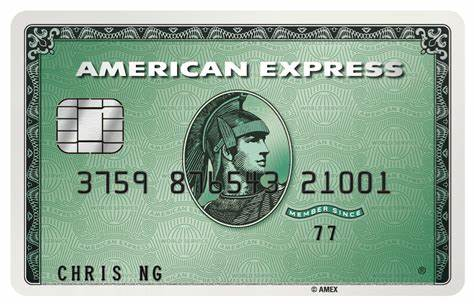

American Express® Green Card

The American Express® Green Card charges a $150 annual fee but provides statement credits for CLEAR® and LoungeBuddy, making it a cost-effective option for travelers. It also offers enhanced rewards rates on everyday expenses compared to the Platinum Card.

Its rewards program offers 3 points per $1 at restaurants, 3 points per $1 on travel (including flights, hotels, transit, taxis, tours, and ridesharing), and 1 point per $1 on other purchases.

No foreign transaction fees apply, and the card includes benefits like LoungeBuddy and CLEAR statement credits, secondary car rental coverage, trip delay insurance, baggage insurance, purchase protection, and extended warranty coverage. However, frequent travelers may prefer more premium cards with higher-end perks.

Blue Cash Preferred® Card from American Express

The Blue Cash Preferred® Card from American Express appeals to families with generous cash-back earnings on groceries and gas, along with valuable credits in specific categories.

The card offers 6% cash back at U.S. supermarkets (up to $6,000 per year, then 1%), 6% cash back on select U.S. streaming subscriptions, 3% cash back at U.S. gas stations and on transit, and 1% cash back on other purchases.

Foreign transaction fees amount to 2.7% per transaction after conversion to US dollars. It also provides $7 in monthly credits for the Disney streaming bundle, up to $120 in statement credits for an Equinox+ membership, secondary car rental coverage, and return protection. However, it may not be ideal for international travel due to foreign transaction fees.

Blue Cash Everyday® Card from American Express

The Blue Cash Everyday® Card from American Express offers elevated rewards on U.S. supermarkets, gas stations, and online spending, making it a suitable choice for households without an annual fee.

Rewards include 3% cash back at U.S. supermarkets and gas stations, and on online retail purchases (up to $6,000 in each category per year, then 1%), and 1% cash back on other purchases.

Foreign transaction fees are 2.7% per transaction after conversion to US dollars. The card also offers $7 in monthly statement credits for a Disney streaming bundle, up to $180 annual statement credit for Home Chef, and secondary auto rental collision damage waiver coverage.

American Express Cash Magnet® Card

Looking for a straightforward cashback option with an Amex card? Consider the American Express Cash Magnet® Card* (terms apply), which offers 1.5% cash back on purchases. You won’t have to worry about an annual fee since it’s $0.

For every purchase made, you’ll receive a 1.5% cashback reward. When using the card for foreign transactions, there will be a 2.7% fee per transaction after conversion to US dollars.

In addition to cashback, the card provides access to Amex Offers and includes secondary rental car coverage² and access to a Global Assist hotline⁴. However, it’s worth noting that there are other cards in the market with more attractive rewards compared to this one.

Amex EveryDay® Preferred Credit Card

Those who rely on their cards for all purchases, big or small, instead of carrying cash, might discover great value in the Amex EveryDay® Preferred Credit Card (terms apply). By using your card at least 30 times in a month, you can receive 50% extra bonus points, giving your earnings a significant boost.

The card comes with an annual fee of $95 and offers rewards such as 3 points per $1 spent at U.S. supermarkets (up to $6,000 per year in purchases, then 1 point), 2 points per $1 on U.S. gas stations and travel purchases made through AmexTravel.com, and 1 point per $1 on other eligible purchases.

When using the card for foreign transactions, there is a 2.7% fee applied to each transaction after conversion to US dollars.

One of the major highlights of this card is the potential to earn a 50% increase in points, particularly advantageous for those who frequently shop at U.S. supermarkets. However, it’s worth noting that for the same annual fee, the Blue Cash Preferred may offer better value overall, especially if you spend a lot on groceries at U.S. supermarkets.

Should you get an American Express credit card?

American Express is renowned for its wide selection of excellent credit card options, backed by top-notch customer service. When it comes to cash back or travel rewards, American Express has something to offer everyone. One of the hidden strengths of American Express lies in its outstanding online portal, providing a best-in-class experience for managing expenses, payments, benefits, and rewards.

Having the ability to live chat with a representative can also come in handy for users. Interestingly, some American Express cards do not come with a credit limit, providing added flexibility, as mentioned by Zac Hood, the founder of TravelFreely.com and a travel rewards educator.

The range of credit cards offered by American Express is diverse, including high-end premium travel cards as well as basic cash-back options, giving customers ample choices to suit their preferences. For those interested in earning Membership Rewards, an American Express card is the only way to do so.

However, if cash-back rewards are what you seek, Amex is just one of many issuers offering such benefits. To find the best fit, comparing the best cards for cash back is essential, including options from different issuers. It’s important to note that American Express cards typically require at least good credit to qualify.

While their acceptance is slightly less common abroad compared to other cards, the company compensates with exceptional customer support, consistently ranking highest in customer satisfaction for three consecutive years, according to a 2022 J.D. Power U.S. Credit Card Satisfaction Study. For those seeking high-end perks, the American Express Platinum Card pioneered the premium card category.

In conclusion, if you qualify for an American Express card that meets your needs, it’s likely you’ll benefit from having it in your wallet.

Pros of American Express cards

- American Express cards offer substantial rewards and perks. Despite some cards having high annual fees, they come with valuable rewards and perks. Take the Platinum Card, for instance, which offsets its nearly $700 annual fee with over $1,500 in potential credits.

- Moreover, cardholders gain access to a vast network of airport lounges. This benefit alone can save you several hundred dollars that you would have otherwise spent on lounge access.

- Another advantage is the ability to pool your Membership Rewards. By doing so, you can save up for significant redemptions or transfers. To maximize your rewards on every purchase, it might be worth considering pairing different American Express cards.

- Furthermore, certain AmEx cards have no preset spending limits. This means you have the flexibility to make larger-than-average purchases occasionally without a strict credit limit holding you back.

Cons of American Express cards

- Earning rewards with American Express cards can be challenging due to their complicated earning structures. These cards often have numerous bonus categories and spending caps to keep track of, which might not be ideal for those seeking simplicity in their rewards system.

- One drawback of using American Express cards internationally is their limited acceptance abroad. While their acceptance is increasing, there are still many places that only take Mastercard or Visa, excluding American Express cards.

- Another factor to consider is the high annual fees associated with some of American Express’ premium cards. Although these cards come with attractive perks, the annual fees can be among the highest in the market.

American Express membership rewards and benefits

The American Express rewards program is called Membership Rewards. You can use the points you earn on Membership Rewards cards for various redemption choices.

The best redemption options are usually for premium travel rewards through an airline transfer partner or the American Express travel redemption portal. Amex transfer partners include British Airways, Delta, Emirates, Virgin Atlantic, and Marriott Bonvoy.

Redeeming points for cash back may be tempting, but it’s usually a lower-value redemption option than travel. You’ll often get a much better return if you use the points toward travel, such as booking flights and hotels through American Express or transferring to a travel partner. It’s almost never a good deal to turn in points for merchandise.

Also, be sure to determine before you apply what type of rewards the Amex card you’re considering offers. Not all Amex cards earn Membership Rewards — some earn straight cash back, which can be redeemed as a statement credit, for example.